The 7-Year Compliance Rule: What Banks Need to Know

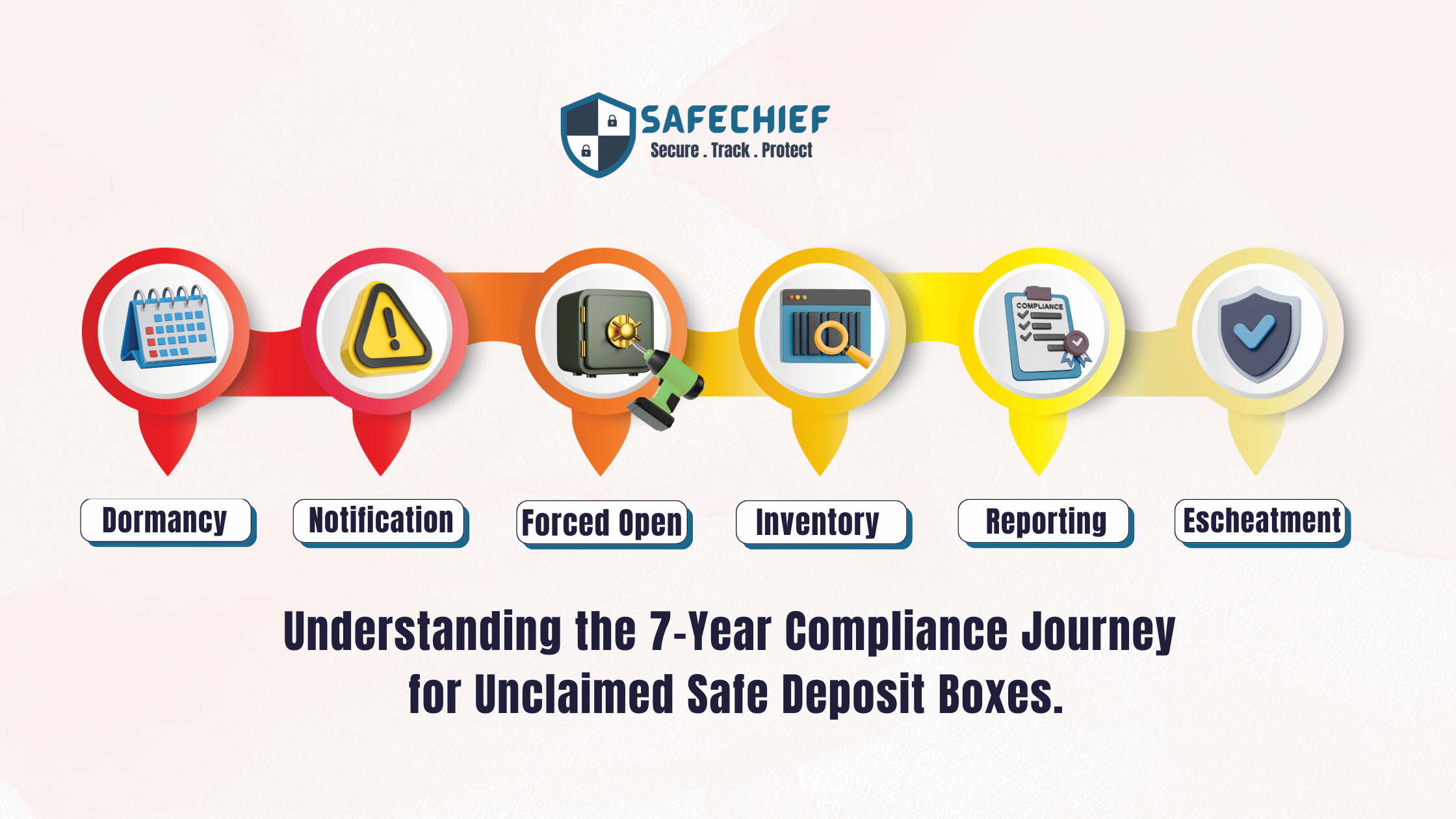

In the financial industry, managing unclaimed safe deposit box (SDB) contents is not just a regulatory requirement, it’s a legal obligation with long-term accountability. Most U.S. states mandate that financial institutions hold unclaimed assets for up to seven years before they are escheated (transferred) to the state. For banks and credit unions, this period is far from passive—it demands structured processes, secure storage, and clear audit trails.

Understanding the 7-Year Rule

Each state enforces its own escheatment laws, but most require institutions to hold dormant assets, such as unclaimed SDBs, for a statutory dormancy period—commonly seven years. During this time, banks are responsible for:

- Ensuring secure custody of unclaimed property

- Conducting due diligence to locate the rightful owner

- Maintaining accurate records of every step

- Reporting and remitting the property to the state if not claimed

Failing to meet these obligations can lead to regulatory penalties, reputational harm, and costly audits.

The Compliance Challenge

Traditionally, banks have relied on manual methods—spreadsheets, internal trackers, paper logs—to manage dormant safe deposit box contents. These systems are time-consuming, error-prone, and difficult to scale across multiple branches or storage locations. Over time, this exposes financial institutions to compliance risks.

Why Automation is Essential

Automation not only reduces manual errors but also helps banks stay compliant with ever-evolving state laws. With automated platforms like SafeChief, banks can:

- Digitally track every box, bag, and transfer

- Create time-stamped audit logs for every action

- Send automated reminders and alerts for due diligence

- Generate real-time, audit-ready reports for regulators.

This means more than just compliance—it’s about peace of mind.

SafeChief: Built for the 7-Year Journey

SafeChief is purpose-built for this exact challenge. Whether managing one box or hundreds, SafeChief ensures:

- Complete chain-of-custody transparency

- Secure storage and tracking using tamper-evident bags

- Simplified workflows for check-ins, transfers, audits, and checkouts

- End-to-end visibility for compliance teams and risk managers

Conclusion

The 7-year rule isn’t just about holding property—it’s about protecting it, tracking it, and proving it was handled properly every step of the way. If your institution is still relying on spreadsheets, it’s time to rethink compliance.

👉 Book a demo with SafeChief and take control of your compliance process today.